The U.S. recently introduced new tariff measures as part of its broader trade strategy. On February 1, 2025, a 10% tariff on imports from China took effect, prompting China to counter with tariffs on U.S. coal, liquefied natural gas, crude oil, agricultural machinery, and certain vehicles. Meanwhile, a planned 25% tariff on imports from Canada and Mexico has been postponed for one month, though a lower 10% tariff remains in place for Canadian energy resources. The ripple effects are likely to be felt by manufacturers, as rising costs for certain inputs put pressure on production expenses, while distributors face higher supplier prices and may have to pass those costs on to their customers.

In Part 2 of our Talking Tariffs series, we delve deeper into how tariffs work and how they are affecting B2B companies. Click here for part 1.

Before we can understand the impacts that tariffs have on business, we first must understand what tariffs are and how they work. With that in mind, here’s a quick primer on the basics of tariffs:

What is it?

A tariff is a tax on imports or exports between sovereign states.

Why is it done?

It is a form of regulation of foreign trade and a policy that taxes foreign products to encourage or safeguard domestic industry.

Who pays it?

Tariffs are typically first paid by the importer but are then passed on to whoever buys from that importer.

What are the components of a tariff?

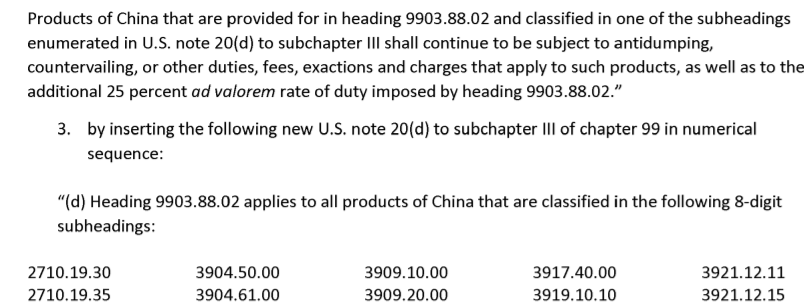

A tariff policy will contain a range of products (defined by HTS codes), a designated country of origin, a tariff fee applied (typically a % of the imported goods) and exclusions. A tariff may be in effect for months or years; however, the list of products excluded from paying the tariff fee are usually updated monthly. Products can be added or removed each month.

Wait, what's an HTS, code?

Harmonized Tariff Schedule codes are numerical identifiers representing a group of products that the exporter assigns. Each individual HTS code covers a narrow scope of products. Data challenges abound with HTS codes as different manufacturers of the same good may assign different HTS codes. For instance:

HTS codes are vitally important for distributors and manufacturers to track, as monthly changes can instantly alter which products are impacted by tariff policy. The trouble is, it becomes a full-time job to administer these changes. Any mistakes made can lead to either large fines or severe hits to margin if costs aren’t updated correctly. Many companies we work with have had to redirect one or two members of their pricing team to handle HTS code administration, which is tedious work that distracts from other proactive pricing functions.

Beyond administration, the major tariff pain comes down to costing and pricing, of course. If a company’s costs are going up because of tariffs, they can either:

Pass the cost increase on in full – relying on sales reps to clearly explain the reasons for the increase so as to not lose volume. Pass the cost increase on in part – suffering margin loss. Change their source of supply – a slow-moving process with more administrative overhead.

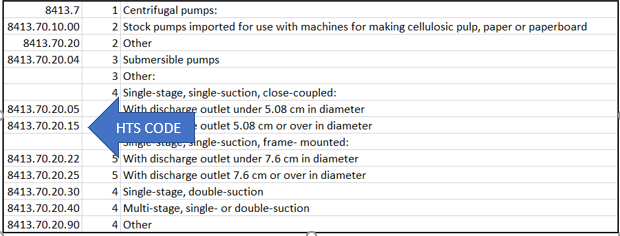

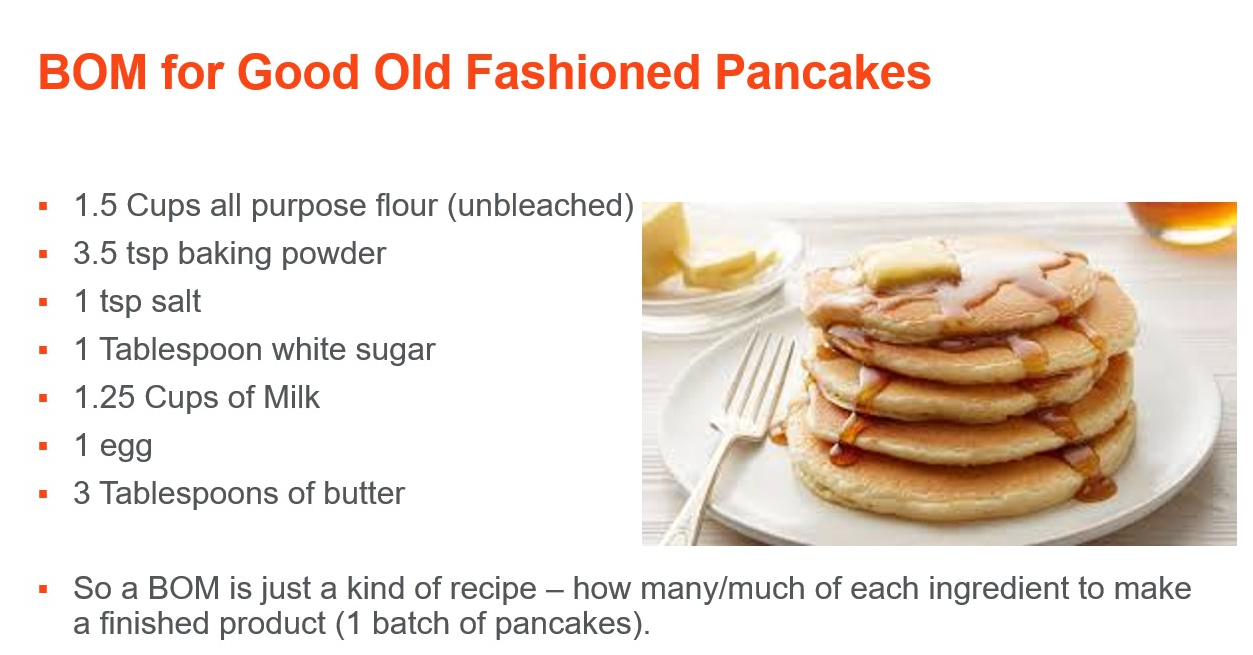

For straightforward cost increases, this problem is easy enough to solve with a centralized price management tool. However, many deals are complex, with tariff-related cost hikes only affecting a portion of the Bill of Materials (BOM). Here is an illustration of that complexity matriculating through the supply chain:

Clearly, it’s a lot to manage. Added on top of the normal pricing activities that B2B companies often struggle to attack strategically, it can become a nightmare.

Simplifying the BOM Scenario

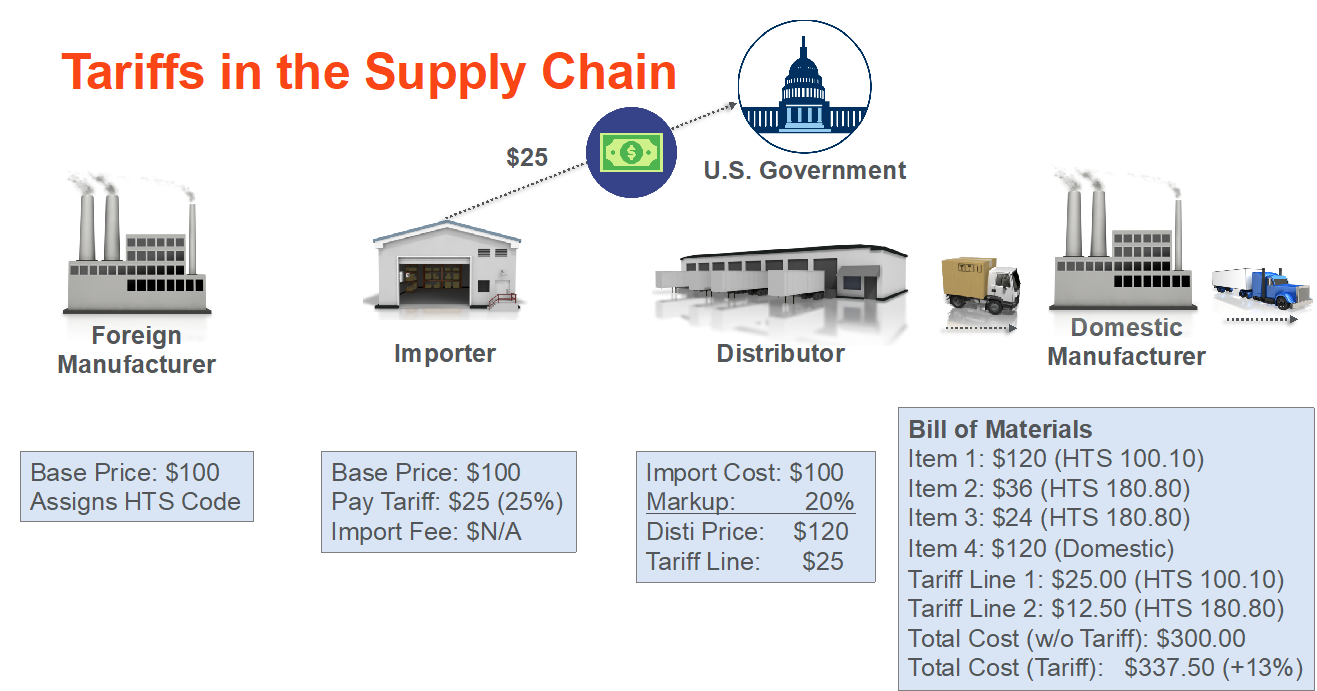

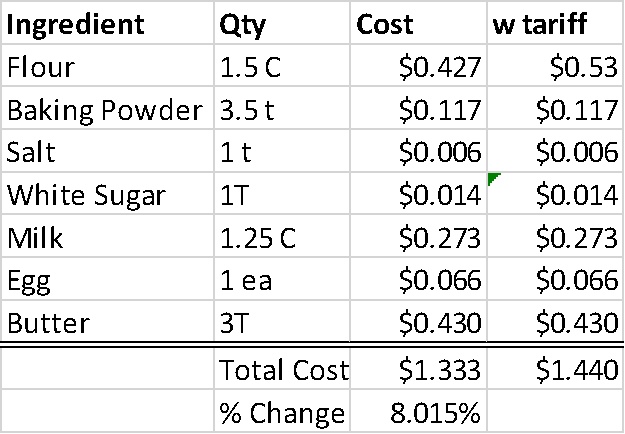

When you look at a BOM like a recipe, this picture becomes clearer. For instance:

Who’s hungry? Now let’s say there is a 25 percent tariff slapped onto flour. Since a pancake isn’t just made up of flour, the cost of the pancake itself doesn’t go up by 25 percent. Pancake buyers who are sensitive to pancake prices will know flour has a tariff, so they’ll expect an increase. But they also know flour is just a fractional ingredient.

Do they know the exact fraction?

Do you, the (pan)cake boss?

Now, in our tasty scenario here, the input cost goes up just over 8 percent. The pancake maker needs to consider its cost pass through strategy. Can it pass on 100 percent of the cost impact? More (or less)? This is where a comprehensive understanding of price elasticity is crucial. The strategy the pancake maker picks will be dependent on its goals – is it seeking to preserve its profit dollars, margin percentage, maintain market share … or some combination of these?

Going a level deeper, price elasticity likely varies by product category, signaling a need for category-aware cost pass through guidance. In our example above, just one category is implicated. But many deals will be vastly more complicated.

What to do about these seemingly endless complexities, changing by the month and muddying the waters of any coherent pricing strategy you’re trying to implement? Talking Tariffs Part 3 is now available, which will prescribe specific solutions to this puzzle.